Our paper (with Othmane Mounjid) “Limit Order Strategic Placement with Adverse Selection Risk and the Role of Latency” has been published in Market Microstructure and Liquidity:

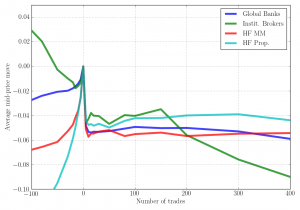

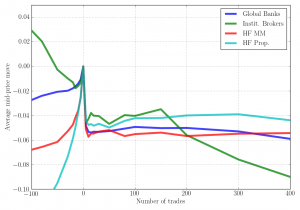

Price moves around the exec. of a limit order (renormalized to be seen as a “buy”) for different types of participants.

ABSTRACT

This paper is split in three parts: first we use labelled trade data to exhibit how market participants accept or not transactions via limit orders as a function of liquidity imbalance; then we develop a theoretical stochastic control framework to provide details on how one can exploit his knowledge on liquidity imbalance to control a limit order. We emphasis the exposure to adverse selection, of paramount importance for limit orders. For a participant buying using a limit order: if the price has chances to go down the probability to be filled is high but it is better to wait a little more before the trade to obtain a better price. In a third part we show how the added value of exploiting a knowledge on liquidity imbalance is eroded by latency: being able to predict future liquidity consuming flows is of less use if you have not enough time to cancel and reinsert your limit orders. There is thus a rational for market makers to be as fast as possible as a protection to adverse selection. Thanks to our optimal framework we can measure the added value of latency to limit orders placement.

To authors’ knowledge this paper is the first to make the connection between empirical evidences, a stochastic framework for limit orders including adverse selection, and the cost of latency. Our work is a first stone to shed light on the roles of latency and adverse selection for limit order placement, within an accurate stochastic control framework.